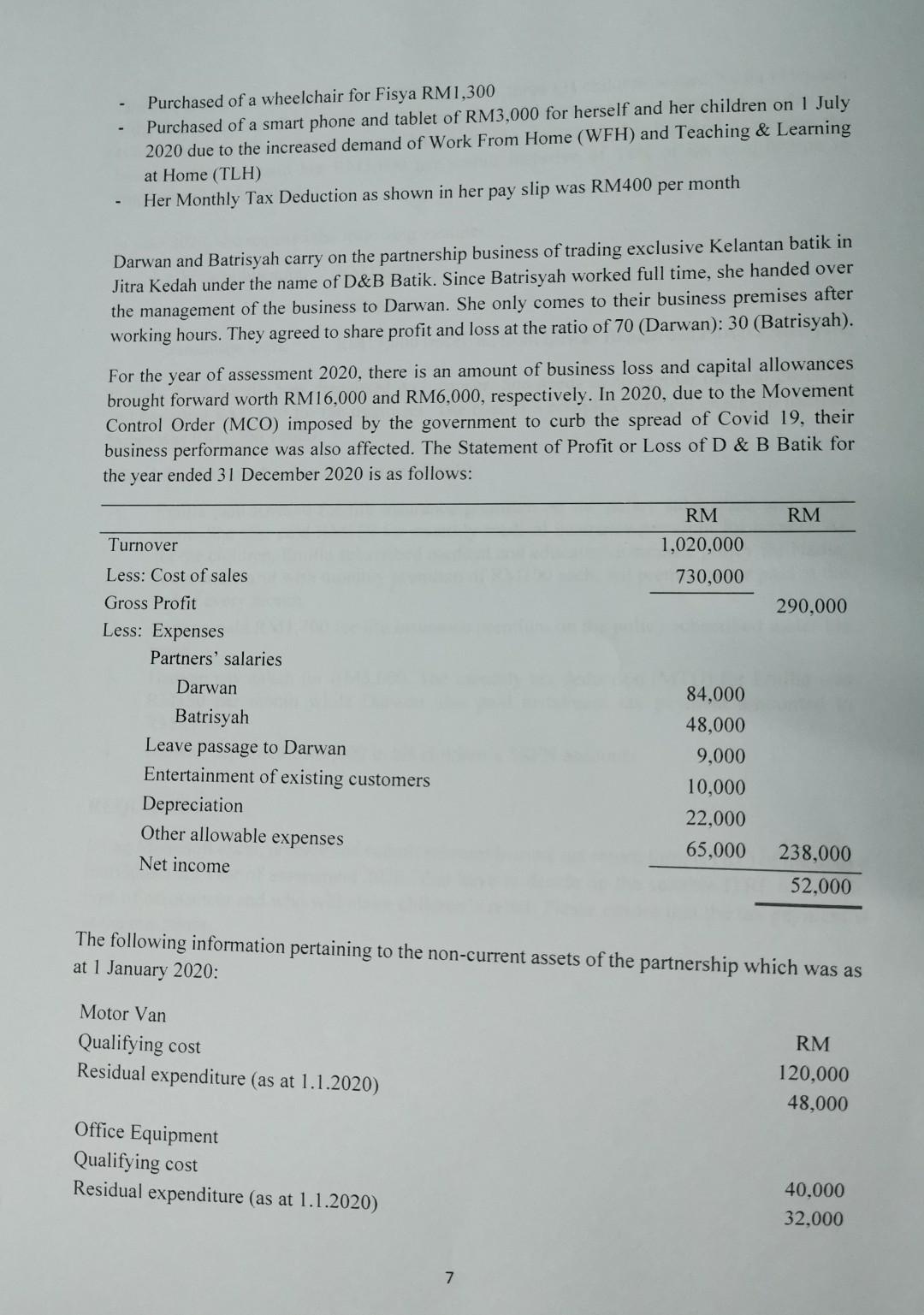

Eligible amount up to RM 300000. Initial allowance 20 Annual allowance 40 Effective.

Deere Co 2021 Annual Report 10 K

Allowance at 40 ie.

. Often overlooked are proper claims of capital allowances on plant and machinery present in a building structure such as fire alarm and. The qualifying expenses are. 72018 Date Of Publication.

Many taxpayers are unaware that this form of tax deduction could lead to their companys efficient tax management. The amount of expenses qualified is limited to RM100000 for 2 years of assessment per tax payer. Tax deduction for costs of.

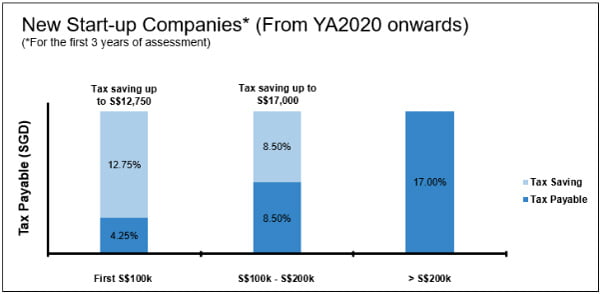

Fully claimable in 2 years. To recap effective from Year of Assessment YA 2020 in order for Small and Medium Enterprise SME to be eligible for the following preferential tax treatments that SME must have gross income from business sources not exceeding RM50 million in that YA in addition to the requirement of having a paid-up capital of not exceeding RM25 million. The amount of deductible RR costs is limited to S300000 for each taxpayer for every three-year period starting from the basis period in which the RR costs are first incurred and a deduction is claimed by the taxpayer.

As highlighted in earlier tax alerts it was proposed that a tax deduction of up to RM300000 be given on costs for renovating and refurbishing business premises where such costs are incurred between 1 March 2020 and 31 December 2021 see EY Take 5. Businesses that incur qualifying expenditure on renovation and refurbishment of its business premises from 1 March 2020 to 31 December 2020 shall be given tax deduction up to RM300000. The total cost of renovation eligible for special deduction under paragraph 331d incurred during these periods are RM300000.

The Section 14Q deduction is applicable to qualifying capital expenses incurred on or after 16 February 2008. Started from 15122020 Malaysia government launch Commercial Renovation and Refurbishment Tax Exemption for public. 35 Company means a body corporate and includes any body of persons established with a separate legal entity by or under the laws of territory outside Malaysia and a business trust.

The Inland Revenue Board of Malaysia IRBM has recently issued Practice Note No. Double deduction for establishment of regional office by International Shipping Companies A tax deduction of up to RM300000 is allowed for expenditure incurred on renovation and refurbishment of premises used for business. QE for capital allowance claim is RM150000 only.

C notional allowance which is equal to the annual allowances if claimed or could have been claimed. Basically Renovation belongs to capital expenditure which are not allowed to tax reduction. Business it is proposed that expenses incurred on renovation and refurbishment of business premises between 10 March 2009 and 31 December 2010 be given Accelerated Capital Allowance that can be claimed within 2 years.

A 381 were gazetted on 28 December 2020. To legislate this the Income Tax Costs of Renovation and Refurbishment of Business Premise Rules 2020 PU. The eligible period is from 1032020 and has been extended to 31122022 from the 2022 Budget Announcement.

QE for capital allowance claim is RM160000. Special tax deduction on costs of renovation and refurbishment To promote businesses to undertake renovation and refurbishment in readiness of the subsequent upturn in the economy costs of renovation. Capital Allowances study is important to ensure the amount of claims is made correctly.

Capital expenditure incurred between 1 March 2020 and 31 December 2020. Subject to this Schedule qualifying expenditure for the purposes of this Schedule is qualifying plant expenditure or qualifying building expenditure within the meaning of paragraphs 2 to 6. Therefore no capital allowance will be given on the cost of preparing the site totaling RM20000.

Economic Stimulus Package 2020 and EY Take 5. 22020 - Claiming Capital Allowance on the Development Cost for Customised Computer Software under the Income Tax Rules 2019. 8 Oktober 2018 INLAND REVENUE BOARD OF MALAYSIA _____ Page 2 of 19 43 The conditions that must be fulfilled by a person to qualify for an initial allowance IA and an annual allowance AA are the same as the conditions to claim capital allowances at the normal rate under Schedule.

Capital Allowances And Charges SCHEDULE 3 Section 42 Capital Allowances And Charges Qualifying expenditure 1. Scenario 2 Cost of preparing the site amounting to RM20000 exceeds 10 of the aggregate cost RM17000. Commercial renovation and refurbishment between 01032020 to 31122022 extended in Budget 2022 can be tax exemption up to RM 300000.

The Practice Note was issued on 16 March 2020 to provide guidance on the implementation of the Income Tax Capital. The Rules provide that in ascertaining the adjusted income of a person from its business for a YA there shall be allowed a deduction capped at RM300000 for the costs of renovation and refurbishment. Regarded as part of the cost of machine.

Is deduction shall not apply if capital allowance under Schedule 2 or Schedule 3 of the Income. Short-term Economic Recovery Plan.

Investment Holding Company What Is It Life Of A Working Adult

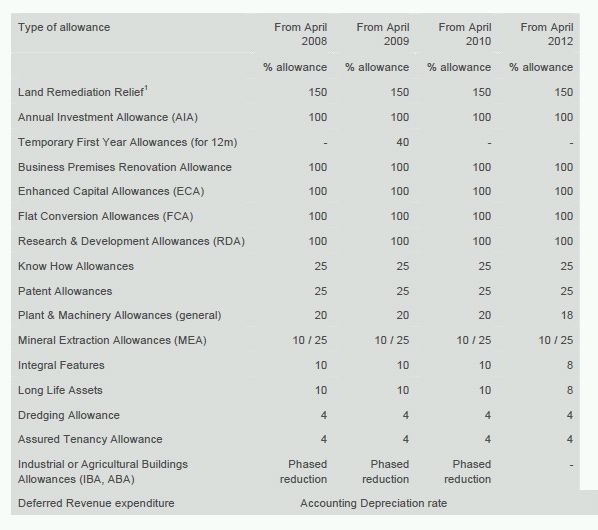

Capital Allowances Recent Changes To Rates Thresholds Etc Tax Authorities Uk

Amirul Is An Entrepreneur Who Owns Three 3 Chegg Com

Financial Planning Cash Flow Pro Forma Statement Income

Why Singapore Ty Teoh International

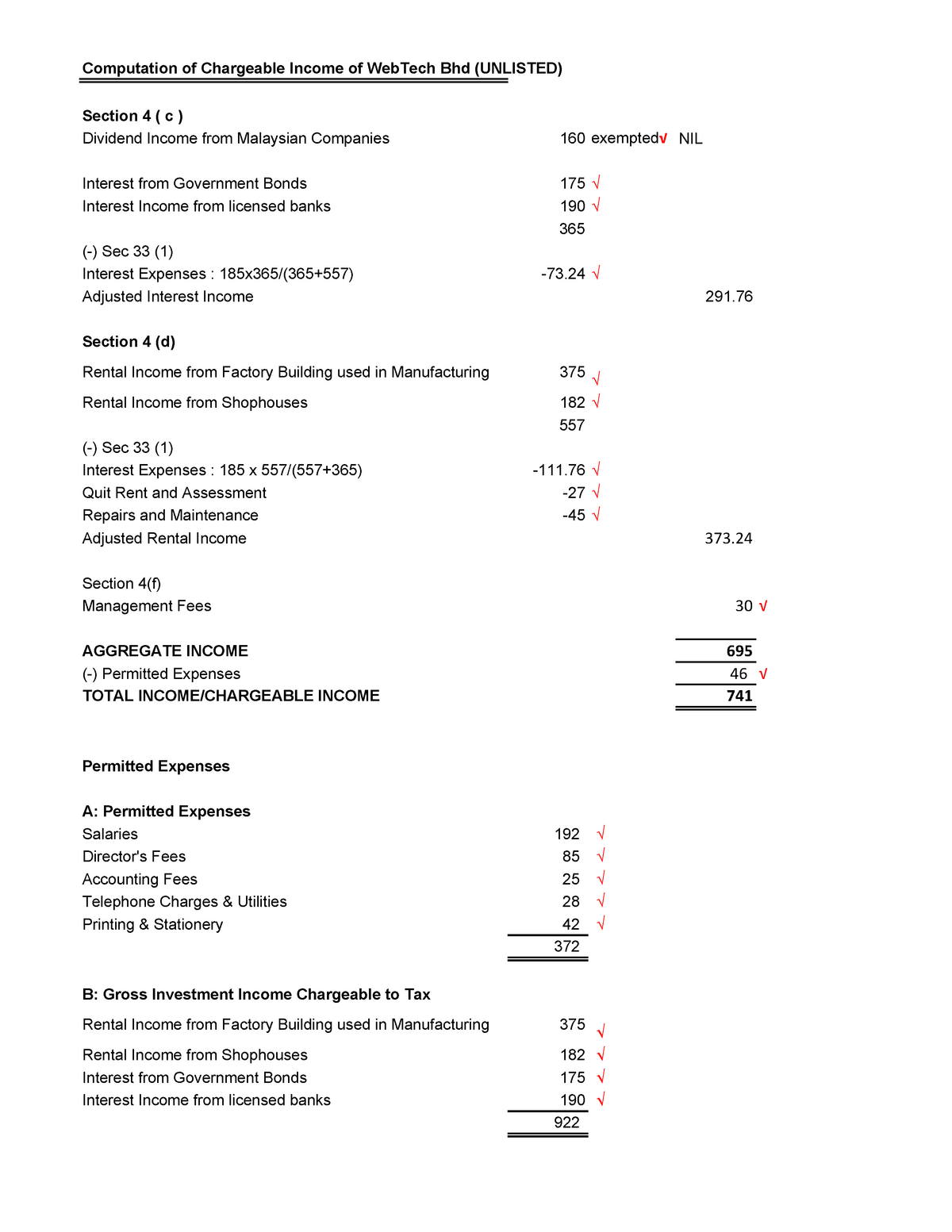

Solution Test 2 Compiled Past Test Question For Studentssssssssssssssssssssss Computation Of Studocu

Financial Planning Cash Flow Pro Forma Statement Income

Biz Exp N Co Tax Tutorial Doc Eab40303 Tax 2 Tutorial Business Expenses And Company Taxation Practice Questions Question 1 Sally Fashion Sdn Bhd Has Course Hero

Enewsletter 01 2021 Current Tax Updates In Malaysia Rsm Malaysia

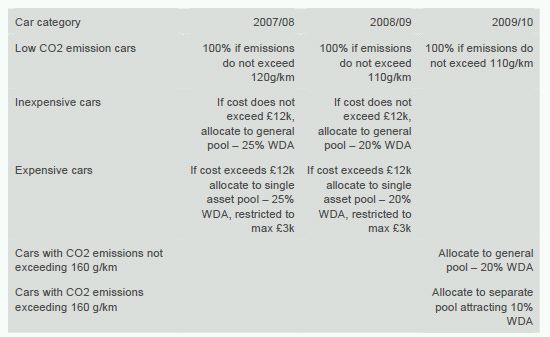

Capital Allowances Recent Changes To Rates Thresholds Etc Tax Authorities Uk

Biz Exp N Co Tax Tutorial Doc Eab40303 Tax 2 Tutorial Business Expenses And Company Taxation Practice Questions Question 1 Sally Fashion Sdn Bhd Has Course Hero

Malaysia S Budget 2022 Key Takeaways For Employers And Hr To Note

Rm20 Billion Fiscal Stimulus Highlights Cheng Co Group

Pdf Tax Avoidance Accounting And Financial Reporting The Perspective Of The Visegrad Group Countries And Serbia

Living On Site While Renovating A New Solvency Standard For New Zealand S Insurers Financial Services Deloitte New Zealand

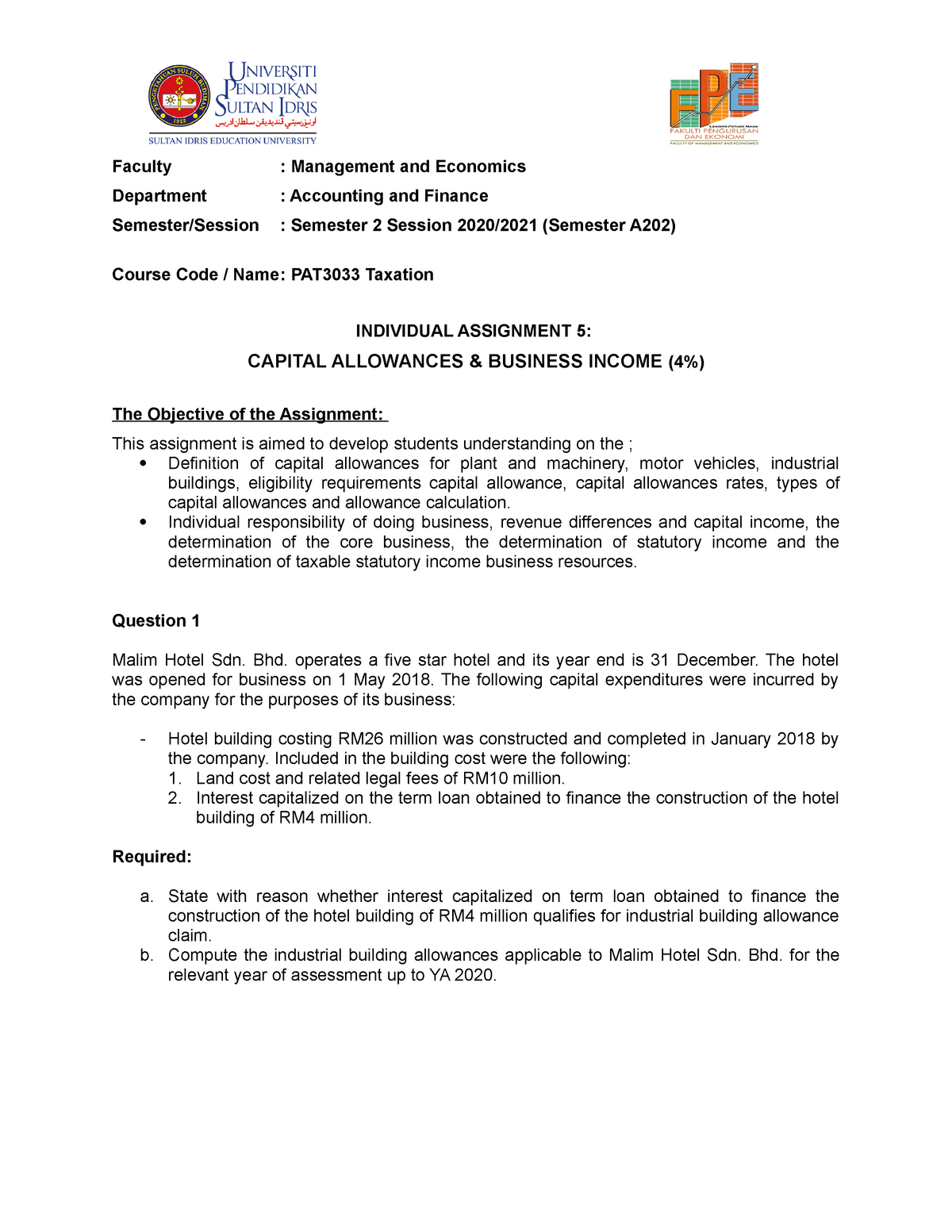

Individual Assignment 5 Capital Allowances And Business Income Faculty Management And Economics Studocu

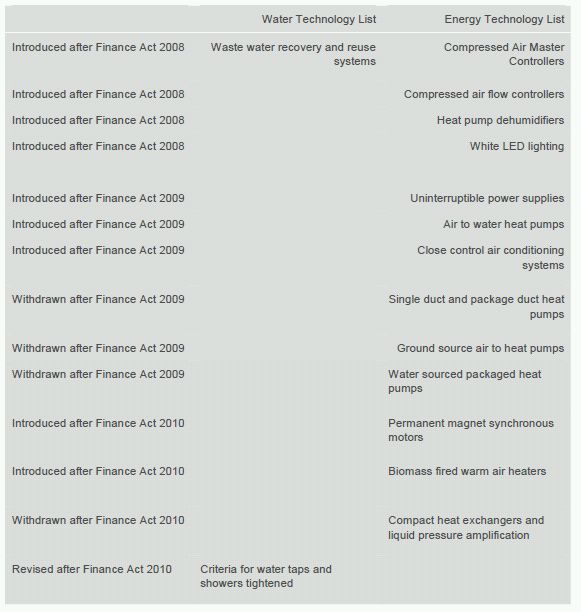

Capital Allowances Recent Changes To Rates Thresholds Etc Tax Authorities Uk